Cryptocurrency investments have been on the rise in recent years. This digital currency has quite quickly become a new type of modern currency. Electronic moneywhich have a number of advantages and disadvantages. We will introduce you to these in the following lines. And what will you find out in this article?

- Know cryptocurrencies in detail

- We reveal the pros and cons of cryptocurrencies

- We will outline cryptocurrency investments for you

This intangible movable thing takes various forms. One of the most famous cryptocurrencies is undoubtedly becoming Bitcoin. Cryptocurrencies are generally associated with strong encryption, hence asymmetric cryptography.

Get to know cryptocurrencies in detail

If you decide to invest in cryptocurrencies, you must first and foremost get to know them thoroughly and well. This medium of exchange is used on many fronts. Thanks to its popularity and prevalence, you can pay for all sorts of goods and services around the world with it. Investment asset taking different forms. A list of the most common cryptocurrencies can be found in the table presented below.

| Cryptocurrency | Shortcut |

| Bitcoin | BTC |

| Ethereum | ETH |

| Binance Coin | BNB |

| Ripple | XRP |

From an investment perspective, of course, you can also find a number of other electronic currencies. Cardano is one of the better known ones. A currency known by the acronym ADA. Then there's Polkadot, Solana and Litecoin, presented under the acronym LTC.

Investing in cryptocurrencies from the ground up

As we revealed a few lines above. Knowledge of the origin of cryptocurrencies and their use is undoubtedly the basis for successful investing. This is true in all areas in which you want to invest your funds. At the beginning of any investment, take the time to study fundamental analysis.

Investment in cryptocurrencies is related to the appreciation of such investment. You can trade any cryptocurrency, including cryptocurrency ETFs.

Michael S., investor.

The cryptocurrencies mentioned above are just a stepping stone and an imaginary beginning of the right investment. You should know that you can invest in dozens or even hundreds of cryptocurrencies.

Benefits of investing in cryptocurrencies

Cryptocurrencies are associated with a variety of benefits. This is why they are a popular worldwide and have become an interesting investment over time. One of the big and fundamental advantages is decentralization, by which you can think of the following.

- There is no central authority

- There's no bank watching anything

- Currency is not controlled by governments

This is a very beneficial benefit in itself. Monetary policy has no power over cryptocurrencies. Investing in cryptocurrencies is therefore an opportunity, although the value itself is influenced by many different factors.

Why invest in cryptocurrencies?

Decentralisation is just a stepping stone in the pursuit of the desired profit. Other positives associated with cryptocurrencies include anonymity. All transactions are anonymous. Thanks to the way the whole system works, no middleman is needed. The communication itself is done through P2P networks.

| Advantage | Description |

| Worldwide use | No border restrictions |

| Security | Strong encryption |

| Transparency | Public blockchain database |

| Saving money | Minimum fees |

Investing in cryptocurrencies will not limit you with high fees. They are minimal or zero. You don't even have to worry about cancelled and missed payments. In the case of cryptocurrencies, such things simply don't happen.

Investing in cryptocurrencies can be high

Just look at the cryptocurrency market and you will certainly feel the need to invest in this segment. For example, the Bitcoin has had some really interesting advances in terms of its value. If you consistently and regularly monitor the cryptocurrency market, you can make high profits.

Historical data shows that some daily gains within Bitcoin have exceeded 200 %.

James P., investor.

Don't forget that you also need a secure wallet to store these digital assets. You can use both virtual and hardware solutions to store your specific electronic currency. Investing in cryptocurrencies is simply a challenge.

Disadvantages of investing in cryptocurrencies

There are pros and cons to each, there is no doubt about that. The same is true of cryptocurrency investments. If you're a nature lover and you're trying to live green, cryptocurrencies go a bit against the grain. This is mainly due to the need for great energy to mine currencies.

- Electricity required for mining

- Lots of powerful hardware

- Other sources

This alone may deter some individuals from investing in cryptocurrencies. If you are a green person, cryptocurrencies may not be of much interest to you.

Other downsides of cryptocurrencies

If we are to delve into the negatives associated with cryptocurrencies, it will certainly be volatility. Behind this term lies a relatively simple and unpretentious definition. Quickly gained and quickly lost. Yes, investing in cryptocurrencies is associated with a rapid increase in value and therefore lightning fast earnings. On the other hand, there is also the risk of high losses and a drop in the value of the cryptocurrency. This is demonstrated by one historical example.

| Subject | Value |

| Year | 2021 |

| Period | April to June |

| Decrease in value | 50 % |

| Cryptocurrency | Bitcoin |

Regulatory constraints can also be seen as a definite minus. Although cryptocurrencies are becoming more and more popular and the number of countries that recognise them is increasing, there are still some exceptions.

Lost investment in cryptocurrencies

Another risk associated with investing in cryptocurrency is the common loss. Yes, the emphasis on high safety in terms of encryption and security is definitely an asset. But what if you lose your private key? Then you'll probably never get to your purchased cryptocurrencies.

Unfortunately, the loss of personal keys is irreversible and cannot be recovered. Therefore, emphasis should be placed on the safe storage and safekeeping of cryptocurrencies.

David R., investor.

Of course, the loss of the hardware wallet designed for cryptocurrencies and electronic currencies in general can also be a risk. Or its theft. Thus, every potential investor must weigh the pros and cons of investing in cryptocurrencies. The final decision is up to each of you.

Investing in cryptocurrencies and everything important

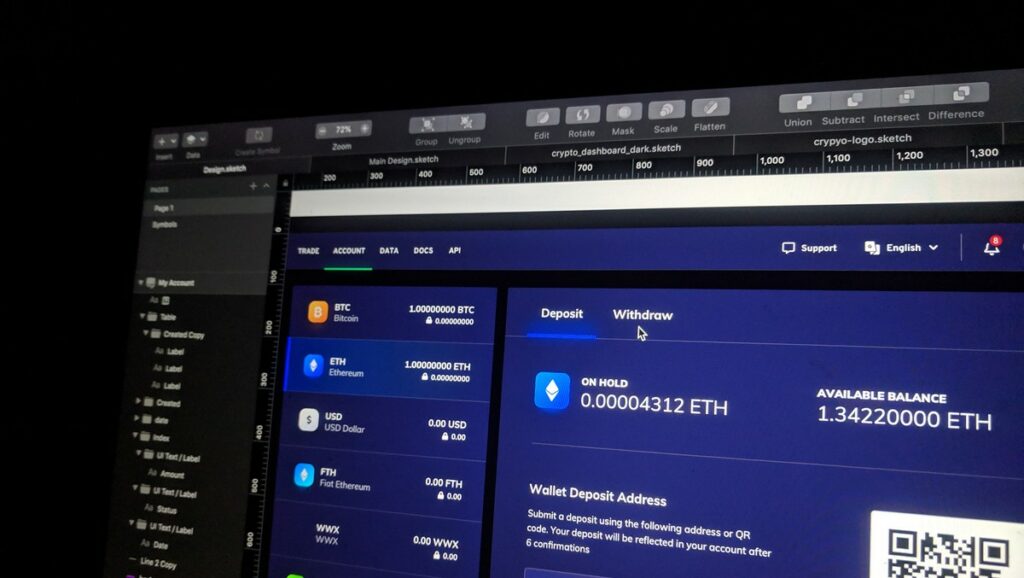

If you decide to invest money in any of the cryptocurrencies, you should first of all choose an appropriate exchange and trading platform. These, by the way, offer wallets where cryptocurrencies can be stored and transferred from there to other places. You can pay for cryptocurrency using the classic and conventional payment method via credit card. You can become the owner of your chosen cryptocurrency in no time.

Questions and Answers

Cryptocurrencies are quite a broad and extensive segment. It involves a lot of important and relevant information. If you are interested in real investments in cryptocurrencies, you may find some of the associated information useful. We bring these to you through the questions and answers presented below.

Market capitalization is definitely the basis of everything. In addition, take into account transaction volume, fees, but also active addresses.

This is one of the metrics used for cryptocurrency valuation, primarily related to the electronic currencies Ethereum and Bitcoin. Hash rate is used for cryptocurrencies with a Proof of Work protocol known as PoW.

Cryptocurrencies are becoming more widespread around the world. Today, you don't just have to use them to pay for purchases in online stores. Select gas stations, brick-and-mortar stores, cafes, restaurants and more are no exception.

It is a chain of blocks ensuring proper unbreakability of cryptocurrencies.

In terms of investing in cryptocurrencies, you will be interested in various exchanges and brokers. These operate on a similar principle to other commodity investments. Any cryptocurrency exchanges or ATMs are no exception.

Is investing in cryptocurrencies the music of the future?

Cryptocurrencies undoubtedly have a future, as evidenced by their development and popularity. This is one of the reasons why they are a real and beneficial investment. On the other hand, you need to know what you are doing. Just as you can acquire money quickly, you can also get rid of it in a flash. In any case, investing in cryptocurrencies is worth considering. At the very least, they can form part of your investment portfoliowhich consists of, for example, completely different commodities.